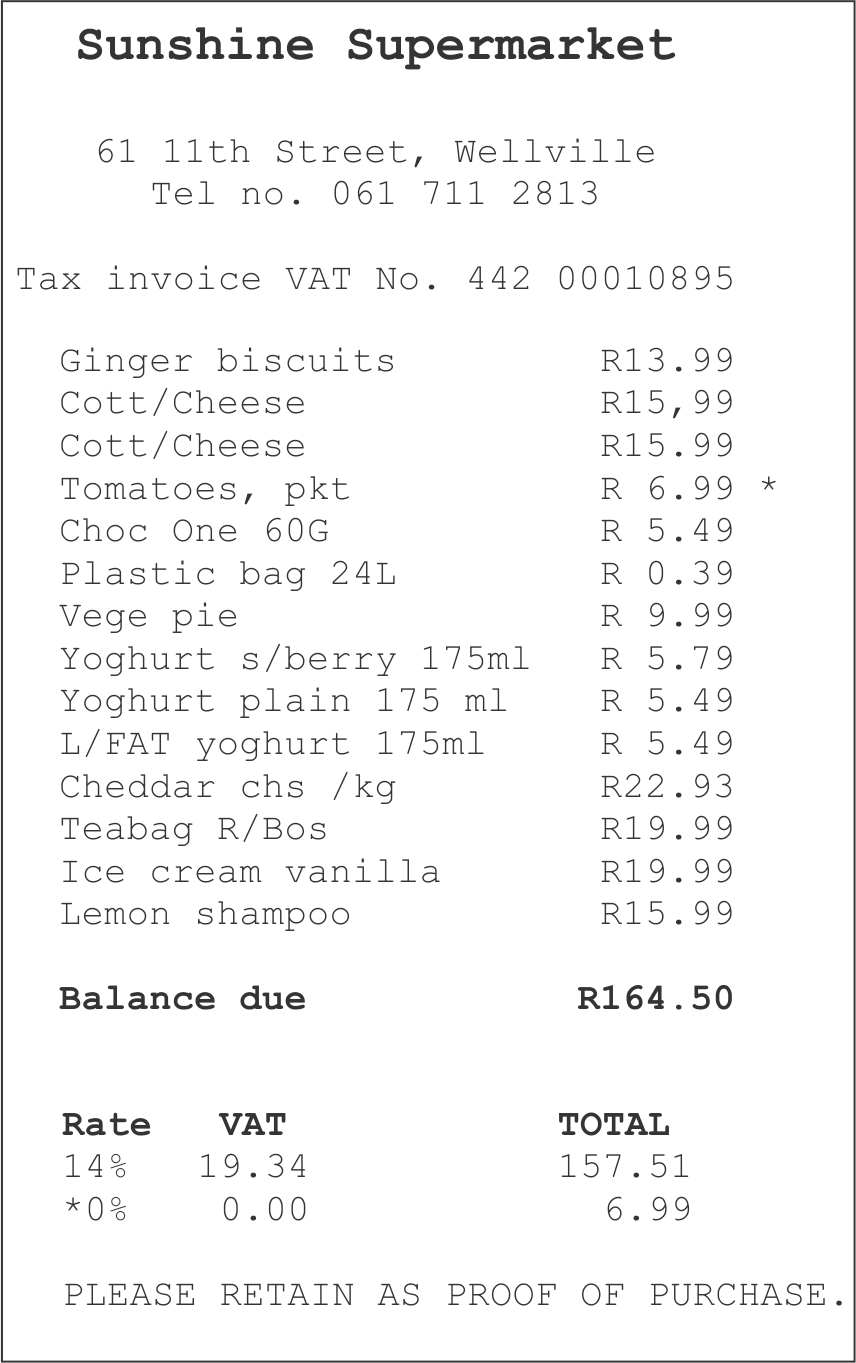

Bongi decides to use the following formula to calculate the cost of the items before VAT, the VAT and the VAT inclusive price.

Total cost (R) = Amount before VAT (R) + \(\text{14}\%\) of the amount before VAT (R).

Complete the table below by calculating the values of a) to g). a) is the total of the Amount (R) and e) is the total of VAT (R). Show all your calculations.

Amount (R) | \(\text{8,76}\) | \(\text{8,76}\) | \(\text{21,92}\) | \(\text{6,13}\) | \(\text{0,35}\) | \(\text{17,54}\) | \(\text{24,55}\) | \(\text{28,06}\) | a. |

VAT (R) | \(\text{1,23}\) | \(\text{1,23}\) | \(\text{3,07}\) | \(\text{0,86}\) | \(\text{0,05}\) | b) | c) | d) | e) |

Total (R) | \(\text{9,99}\) | \(\text{9,99}\) | f) | g) | h) | \(\text{19,98}\) | \(\text{27,99}\) | \(\text{31,99}\) | \(\text{132,32}\) |

a) = \(\text{R}\,\text{8,76}\) + \(\text{R}\,\text{8,76}\) + \(\text{R}\,\text{21,92}\) + \(\text{R}\,\text{6,13}\) + \(\text{R}\,\text{0,35}\) + \(\text{R}\,\text{17,54}\) + \(\text{R}\,\text{24,55}\) + \(\text{R}\,\text{28,06}\) = \(\text{R}\,\text{116,07}\)

b) =\(\text{R}\,\text{19,99}\) - \(\text{R}\,\text{17,54}\) = \(\text{R}\,\text{2,44}\)

c) =\(\text{R}\,\text{27,99}\) - \(\text{R}\,\text{24,44}\) = \(\text{R}\,\text{3,55}\)

d) = \(\text{R}\,\text{31,99}\) - \(\text{R}\,\text{28,06}\) = \(\text{R}\,\text{3,93}\)

e) = \(\text{R}\,\text{132,01}\) - \(\text{116,07}\) = \(\text{R}\,\text{15,94}\)

f) = \(\text{R}\,\text{21,92}\) + \(\text{R}\,\text{3,07}\) = \(\text{R}\,\text{24,99}\)

g) = \(\text{R}\,\text{6,13}\) + \(\text{R}\,\text{0,86}\) = \(\text{R}\,\text{6,99}\)

h) = \(\text{R}\,\text{0,35}\) + \(\text{R}\,\text{0,05}\) = \(\text{R}\,\text{0,40}\)